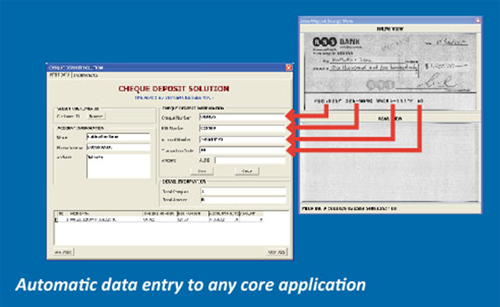

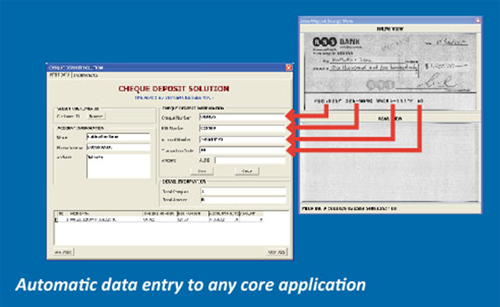

Specifically developed to simplify the processing of cheque deposits at tellers or cheque payments at retail POS networks, SMARTCHEQUEENTRY™ helps overcome your persisting issues including cheque frauds, errors in data entry and the insecurity of dealing with and cheque handling by third party vendors—thus keeping your operational costs low and minimizing your losses. SMARTCHEQUEENTRY™ will help you address these challenges.

Minimise involvement of third party vendors with SMARTCHEQUEENTRY™, a solution that gives you the best value for money while streamlining your cheque processing and yet maintaining quality of your cheque handling.

Or, if you are exploring ways to increase your profits by leveraging on business partnerships, you may also consider building a service network with SMARTCHEQUEENTRY™ to facilitate cheque payment at various retail point of sales.

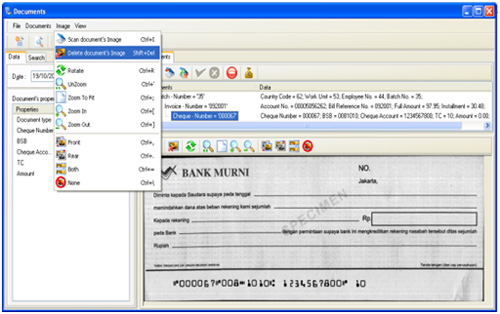

All cheque images and data processed on SMARTCHEQUEENTRYTM is automatically archived into its own database for future retrieval.

Its user friendly search tool allows authorized users to easily look for specific data using definite or range of values such as deposit date, serial number, routing number (BSB number), transaction code and account number. This makes it easier to check against past deposit or payment records.

Exportable Data – All archived images and data can be exported into other format for further processing or backup purposes. Options of images’ black and whites are also available to minimize storage space.

Get access to exclusive content and special offers.

Will be used in accordance with our Privacy Policy